VC Investment in Canada for Life Sciences Companies

Deal count and volume remains cautiously optimistic

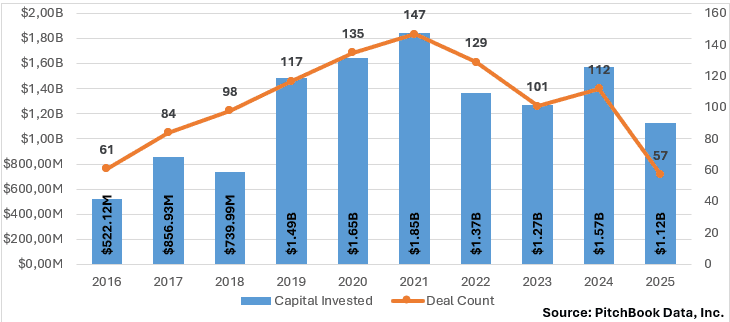

Despite recent pullbacks in biotechnology and life sciences venture capital (“VC”) funding in Canada, a more in-depth analysis reveals strong indicators of investment demand for capital in early stage Canadian life sciences companies. While overall deal count has declined since 2021, such a reduction appears to be stabilizing between pre-pandemic averages, as opposed to demonstrating a stark pullback in overall dealmaking appetite. Even in light of such a decrease in deal volume, the amount of capital invested in 2024 ($1.57 billion) was comparable to pandemic levels of VC investment in Canadian life sciences companies, indicating individual deal sizes are getting larger (see Figure 1).

Figure 1: Annual VC capital investment and deal count across Canadian life sciences companies from January 1, 2016 to September 30, 2025.[1]

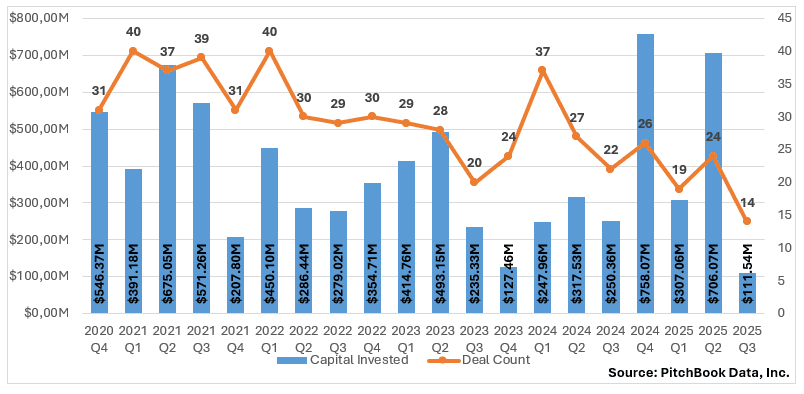

VC investment in the emerging life sciences industry in Canada undeniably boomed during the pandemic. Despite a reduction in activity after 2021, VC investments, from the perspective of capital invested and deal count, have remained significantly above pre-pandemic levels. A more granular analysis shows that 2024 Q4 was the quarter with the most VC investment in the industry over the last five years, with 2025 Q2 trailing not far behind (see Figure 2). Notably, 2025 Q2 saw the one of the single largest VC investment in nine years with Jane Software’s $500 million secondary financing round.

Jane Software provides practice management software for small and medium-sized healthcare clinics in Canada and globally to book appointments, manage billing and handling digital forms. Despite having raised less than $10 million in primary funding, the financing round valued Jane Software at approximately $1.8 billion. With the company close to achieving US$100 million in annual recurring revenue and achieving such a large valuation with minimal primary funding, Jane Software can be considered one of Canada’s most successful bootstrapped tech companies.[2]

Figure 2: Quarterly VC capital investment and deal count across Canadian life sciences companies.

Cross-Canada Comparison

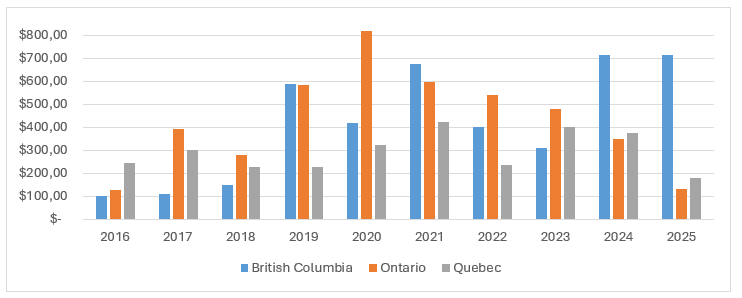

British Columbia, Ontario, and Québec represent the provinces with the largest share of total capital invested in life sciences companies across the country, with British Columbia continuing to have large VC investments in this industry following the pandemic (see Figure 3). British Columbia in particular saw over $700M in VC investment in their life sciences companies in 2024 and will likely exceed it in 2025. VC investments into British Columbia life sciences companies represented nearly half of all VC funding in the Canadian life sciences ecosystem for both 2024 and 2025. While Québec has maintained steady investment since 2016, VC investment in Ontario appears to be trending towards pre-pandemic levels.

Figure 3: Annual VC capital investment by province across Canadian life sciences companies from January 1, 2016 to September 30, 2025.

Sectoral Analysis

Sectors that saw the largest investments year-over-year are Biotechnology, Drug Discovery, Diagnostic Equipment, Discovery Tools (Healthcare) and Enterprise Systems (Healthcare).

| Sector | Sector Description |

| Biotechnology | Companies engaged in research, development, and production of biotechnology (includes embryology, genetics, cell biology, molecular biology, and biochemistry, among others). |

| Drug Discovery | Researchers and developers of new drugs (includes identification, screening, and efficacy testing of drug candidates, among others). |

| Diagnostic Equipment | Manufacturers of imaging and non-imaging devices used to assess and diagnose medical conditions (includes X-ray and MRI machines, otoscopes and stethoscopes, and ultrasound equipment, among others). |

| Discovery Tools (Healthcare) | Researchers and developers of tools used in drug discovery and drug delivery research (includes compound libraries, enzymes, kinases, and specialized proteins, among others). |

| Enterprise Systems (Healthcare) | Developers and producers of software and systems that cover multiple areas of the healthcare organization. |

Figure 4: Descriptions of the sectors receiving the largest YoY investment in the life sciences industry.

The Biotechnology sector made up 12% of total VC investment in the life sciences industry since 2016 (with a noticeable increase in VC investment in 2024), as VC investments more than doubled from years prior.

Despite the Drug Discovery sector accounting for 29% of total VC investment in life sciences industry in Canada since 2016, the Drug Discovery sector saw the largest noticeable drop in VC funding, down 60% in 2024 when compared to its 2021 average. Only 12% of total life sciences VC funding went to the Drug Discovery sector in 2024, a considerable reduction when considering that investment in this sector made up at least 33% on average of total VC investment in Canadian life sciences companies from 2016 to 2023.

The Healthcare Enterprise Systems sector made up 10% of total VC investment in the life sciences industry since 2016 and has seen as significant up-tick in 2025, with approximately 45% of VC investments in 2025 Q1 through Q3 being in this sector.[3]

Key Takeaways

The overall trend of moving away from longer, riskier investments in drugs that are contingent on successful clinical trials and regulatory approval is consistent with the adversity to risk that the VC industry is experiencing as the cost of capital has increased considerably since the start of the decade.[4] Investment volumes suggest that companies specializing in hardtech medical devices and digital health enterprise solutions have been the beneficiaries of this dry powder (especially when coupled with the fact that overall deal size has been increasing). The increasing use of earnouts and representations and warranties insurance can be helpful ways for parties to mitigate the inherent challenges of valuing early stage life sciences companies, whereby much of their value is contingent on the success of its existing and future IP. Earnouts and financing conditions tend to be linked to the achievement of regulatory or R&D milestones, compared to meeting traditional commercial benchmarks like sales targets.

The life sciences industry is one that both the federal and various provincial governments have, especially as of recently, doubled down on and announced several initiatives that are geared towards growing and supporting life sciences startups. Whether government-funded initiatives aimed at fostering and incubating nascent life sciences startups will translate to an increased VC investment appetite in this industry in the second half of the decade remains to be seen. Partnerships with larger pharmaceutical companies are also proving to be an additional source of fundraising, particular for companies in the early stages of development.[5]

In addition to an expansion in annual tax incentives for the Scientific Research and Experimental Development (SR&ED) program, the federal government recently announced in its 2025 Budget intention to restore eligibility of SR&ED capital expenditures and increase the annual expenditure limit on which the SR&ED program’s enhanced credit can be earned and extend enhanced credit to eligible Canadian public corporations which could further incentivize the creation, commercialization, and retention of IP in Canada.[6] Nearly a billion dollars over the next five years is also geared towards boosting AI computing capacity for public and private research, which presents opportunities for life sciences companies whose business models pertain to proprietary algorithms.[7] The Budget also calls for extending the Elevate IP program and extending the IP Assist Program, which can be further leveraged by life sciences startups.[8]

While deal count has dropped below pandemic levels, it has stabilized above pre-pandemic averages, and there are several indicators demonstrating the Canadian life sciences industry is poised to continue attracting growing levels of VC investment in the years ahead. Given the lower levels of funding in recent years, entrepreneurs are motivated to seek out additional funding, and the current data suggests that strategic acquisitions are still closing despite market uncertainty.

If you have any questions, please do not hesitate to contact the authors or any member of our Life Sciences Group.

[1] This was largely attributable to the $500 million secondary financing round by Jane Health that took place during this time period.

[3] Ibid.

[4] Page 89, Budget 2025.

[5] Page 92, Budget 2025.

[6] Page 94, Budget 2025.